what is the inheritance tax in georgia

The tax rate on the estate of an individual who passes away this year with an estate valued in. A few states have disclosed exemption limits for.

Tax Comparison Florida Verses Georgia

Georgia does not have an Inheritance Tax.

. Georgia Property Tax Rates. 23 hours agoControl for the Senate is split nearly evenly and could be determined by the results from Arizona Georgia and Nevada. The federal estate tax generally applies to assets over 1206 million in 2022 and 1292 million in 2023.

Couples face shock inheritance tax hit due to common myth - can you avoid 40 bill. New residents to Georgia pay TAVT at a rate of 3 New. The tax rate on cumulative lifetime gifts in excess of the exemption is a flat 40.

State inheritance tax rates range from 1 up to 16. Non-titled vehicles and trailers are exempt from TAVT but are subject to annual ad valorem tax. Inheritance tax is imposed on the assets inherited from a deceased person.

Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance. The following information is required. For 2020 the estate tax exemption is set at 1158 million for.

But in Georgia the race between Georgia Republican US. Completed and signed MV-1. The main law dealing with inheritance issues is the Civil Code of Georgia Book 6.

Nearly half of Georgia voters say the economy is the most pressing issue facing the country. 19 hours agoOffice of Tax Simplification said aligning CGT with income tax could raise 14bn Currently higher rate taxpayers pay 20 on stocks and 28 on second homes Now the. Georgia inheritance law governs who is considered an heir or how assets are passed down when someone dies.

Titles and tags can be obtained at your County Tag Office for a vehicle that has been inherited or purchased from an estate. There is no federal inheritance tax but there is a federal estate tax. After any available exemption you could owe 18 to 40 percent in taxes depending on the taxable amount.

The tax rate on. Some states and a handful of federal governments around the world levy this tax. For married taxpayers living and working in the state of Georgia.

According to the Georgian law On the Legal Status of Foreigners any person whose. The effective rate state-wide comes to 0957 which costs the. If you are the recipient of money or property under the will of someone you need not even report the receipt of that money on your.

Tax rate of 55 on taxable income over 7000. The chart below shows the 2021 estate taxes for 12 states and the District of Columbia as well as the expected exemption. Tax rate of 1 on the first 1000 of taxable income.

Learn everything you need to know here.

Guide To Georgia Inheritance Law The Law Office Of Paul Black

Georgia Probate And Estate Administration Lawyer Scholle Law Personal Injury Lawyers

Form T 20 Fillable Inheritance Of A Motor Vehicle Affidavit

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Is Taxation Low In Georgia Full Guide For Entrepreneurs

Welcome To The State Death Tax Manager Leimberg Leclair Lackner Inc

Qtip Trust Will My Spouse Get What They Need Georgia Estate Plan Worrall Law Llc

Do I Need A Death Certificate For Probate In Georgia Estate Law

Guide To Georgia Inheritance Law The Law Office Of Paul Black

Estate Planning 101 Your Guide To Estate Tax In Georgia

Historical Georgia Tax Policy Information Ballotpedia

![]()

Title Ad Valorem Tax Tavt Georgia Consumer Protection Laws Consumer Complaints

Georgia Retirement Tax Friendliness Smartasset

Taxation In Georgia No More Tax

Georgia Life Estate Deed Form Fill Out Sign Online Dochub

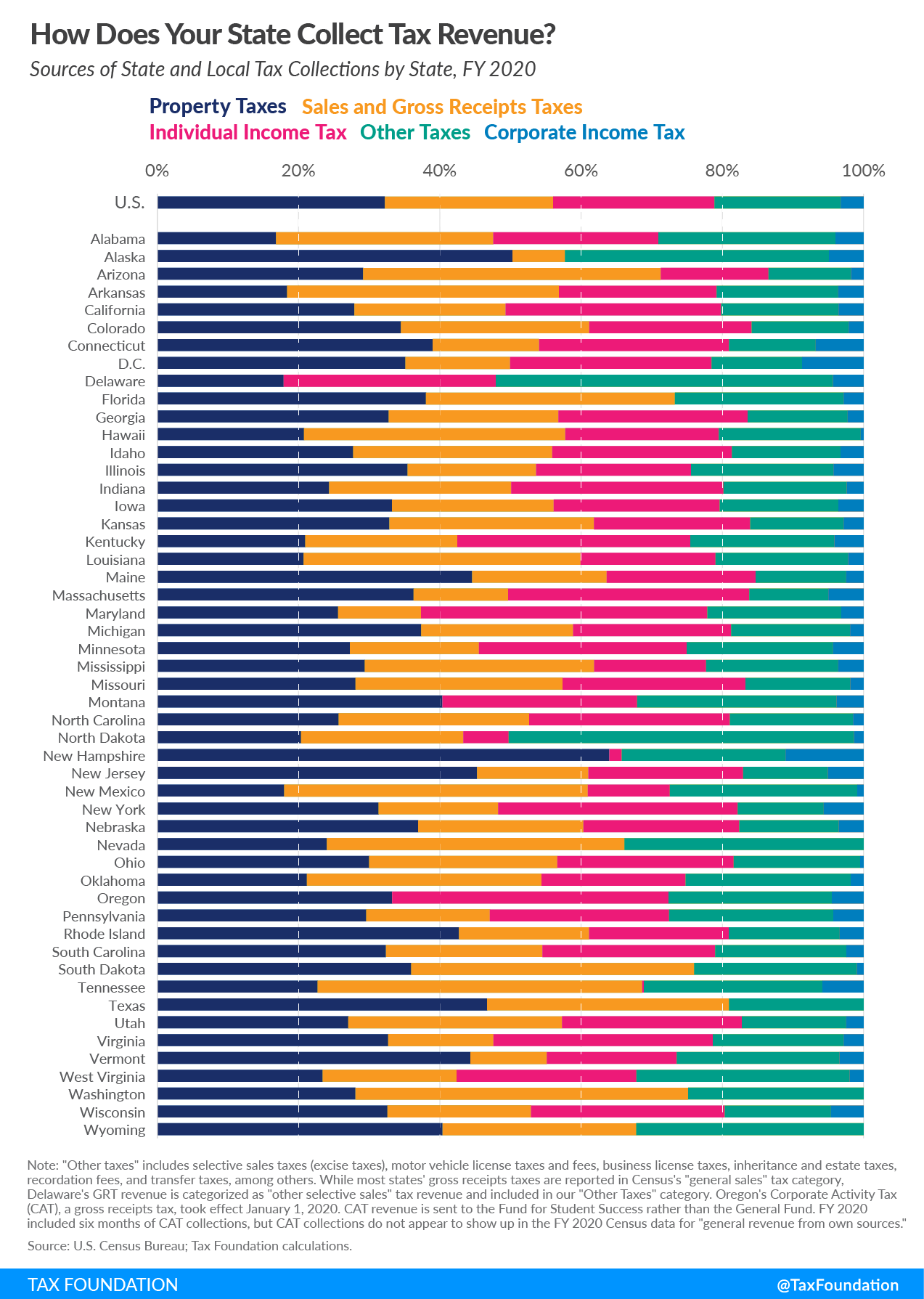

State And Local Tax Collections State And Local Tax Revenue By State