nebraska auto sales tax

Vehicle Title Registration. For use of the vehicle for business charity charitable reasons medicine or transportation the operating expenses could qualify you for a deduction.

Nebraska Motor Vehicle Bill Of Sale Form Pdfsimpli

The cost to register your car in the state of NE is 15.

. Nebraska Sales and Use Tax Guide on Leased Motor Vehicles Information Guide June 10 2014 Page 3 If the terms of the lease agreement are changed the total amount paid to the lessor is subject to Nebraska sales tax on the date of the change at the rate in effect at the lessees primary location. A vehicle that is recorded on the Purchasers Agreement which in turn is used to complete the Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales Form 6 as a trade-in must be titled in the name of the purchaser. There is a 5 sales tax on cars in Nebraska.

Or Form 6XMB Amended Nebraska Sales and Use Tax Statement for Motorboat Sales. Purchase of a 30-day plate by a nonresident of Nebraska who does not intend. Instructions for County Treasurers.

The Nebraska state sales and use tax rate is 55 055. The Nebraska sales tax on cars is 5. State funds go toward a number of projects and programs that benefit all citizens.

February 8 2022 by Molly. The point of delivery determines the location of the sale. Form Title Form Document Nebraska Tax Application with Information Guide 022018 20 Form 55 Sales and Use Tax Rate Cards Form 6 Sales and Use Tax Rate Cards Form 65 Sales and Use Tax Rate Cards Form 7 Sales and Use Tax Rate Cards Form 725 Sales and Use Tax Rate Cards Form 75 Sales and Use Tax Rate Cards Form Nebraska Application for Direct.

Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less. In the state of Nebraska sales tax is legally required to be collected from all tangible physical products being sold to a consumer. The maximum local tax rate allowed by Nebraska law is 2.

The MSRP on a vehicle is set by the manufacturer and can never be changed. Once the MSRP of the vehicle is established a Base Tax set in Nebraska motor vehicle statutes is assigned to the specific MSRP range and motor vehicle tax is then assessed. Nebraska has a 55 statewide sales tax rate but also has 334 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0824 on top of the state tax.

What Is Vehicle Sales Tax In Nebraska. Vehicles in Nebraska are registered in the county where the vehicle has situs which means in the county where the vehicle is housed majority of the time. Select the Nebraska city from the list of popular cities below to see its current sales tax rate.

Nebraska follows most other states when it comes to sales taxes. An example of items that exempt from Nebraska sales tax are certain kinds of prescription medications and some types of medical devices. The percentage of the Base Tax applied is reduced as the vehicle ages.

In addition to taxes car purchases in Nebraska may be subject to other fees like registration title and plate fees. A fillable Form 6 Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales is now available on DORs website. Deliveries into another state are not subject to Nebraska sales tax.

This means that depending on your location within Nebraska the total tax you pay can be significantly higher than the 55 state sales tax. Form 6MB Nebraska Sales and Use Tax Statement for Motorboat Sales. Nebraska SalesUse Tax and Tire Fee Statement.

This is because the first bracket is fairly wide 0 - 3999 and has only a 25 tax when new. To remain in Nebraska more than 30 days from the date of purchase. The state of NE like most other states has a sales tax on car purchases.

For 2017 a taxpayer can deduct both local and state income taxes but not both local and state sales taxes. An automobile purchase for a private or small business can have tax benefits. 31 rows Nebraska NE Sales Tax Rates by City Nebraska NE Sales Tax Rates by City The state sales tax rate in Nebraska is 5500.

This is less than 1 of the value of the motor vehicle. Deliveries into a Nebraska city that imposes a local sales tax are taxed at the state rate 55 plus the applicable local rate. Purchases of new automobiles in Nebraska are subject to the sales tax.

Nebraska has recent rate changes Thu Jul 01 2021. Please sign in with your Nebraskagov subscriber login. There is a 5 tax on cars in Nebraska.

A transfer of a motor vehicle pursuant to an occasional sale as set out in Nebraska. The state of Nebraska also taxes cars just like most other states. Municipal governments in Nebraska are also allowed to collect a local-option sales tax that ranges from 0 to 45 across the state with an average local tax of 0824 for a total of 6324 when combined with the state sales tax.

Nebraska collects a 55 state sales tax rate on the purchase of all vehicles. Qualified businessprofessional use to view vehicle title lien and registration information. Newly purchased vehicles must be registered and sales tax paid within 30 days of the date of purchase.

You can find these fees further down on the page. Nebraska Sales Tax on Cars. Nebraska has a statewide sales tax rate of 55 which has been in place since 1967.

Subsequent brackets increase the tax 10 to 40 for each 2000 of value when new or two percent. Nebraska vehicle title and registration resources. Sales and Use Tax Regulation 1-02202 through 1-02204.

Registration is required with each vehicle purchase to establish. With local taxes the total sales tax rate is between 5500 and 8000. The sales tax rate is calculated at the rate in effect at that location.

Notification to Permitholders of Changes in Local Sales and Use Tax Rates. If you drive in NE you will have to register your car for 175 per vehicle. Department of Revenue Current Local Sales and Use Tax Rates.

This means that an individual in the state of Nebraska who sells computer. Nebraska Non-motor Vehicle Sales Tax Collections by County and Selected Cities 19992020 Annual Non-motor Vehicle Sales Tax Collections Monthly Non-motor Vehicle Sales Tax Collections Non-motor vehicle sales tax collections are compiled from county and city information that is selfreported by applicants when requesting a sales tax permit. Registration is 150 in NE for cars at which point they need to be registered.

All sales tax revenues go towards a series of state-funded projects and programs. Money from this sales tax goes towards a whole host of state-funded projects and programs.

Sales Tax On Cars And Vehicles In Nebraska

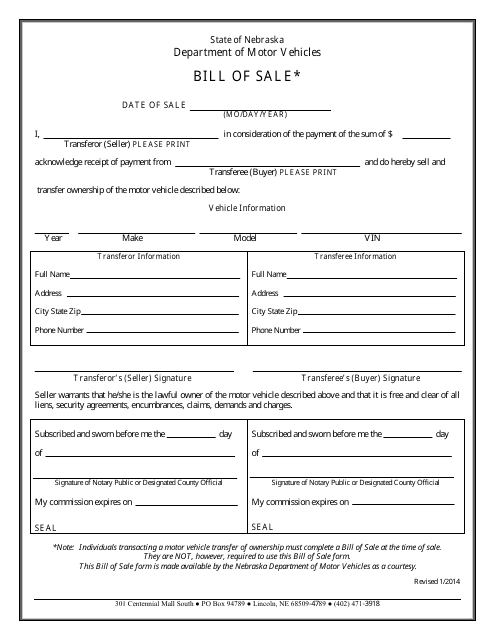

Free Nebraska Vehicle Bill Of Sale Forms Fill Pdf Online Print Templateroller

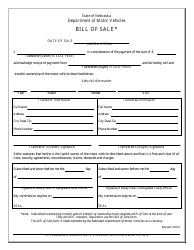

Free Nebraska Motor Vehicle Dmv Bill Of Sale Form Pdf

![]()

Free Nebraska Motor Vehicle Bill Of Sale Form Pdf Word

Free Nebraska Vehicle Bill Of Sale Forms Fill Pdf Online Print Templateroller

What S The Car Sales Tax In Each State Find The Best Car Price

Free Nebraska Bill Of Sale Forms Formspal

How The Nebraska Wheel Tax Works Woodhouse Nissan

Bill Of Sale Nebraska Fill Out And Sign Printable Pdf Template Signnow

17 Printable Nebraska Vehicle Purchase Contract Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

All About Bills Of Sale In Nebraska The Forms And Facts You Need

Taxes And Spending In Nebraska

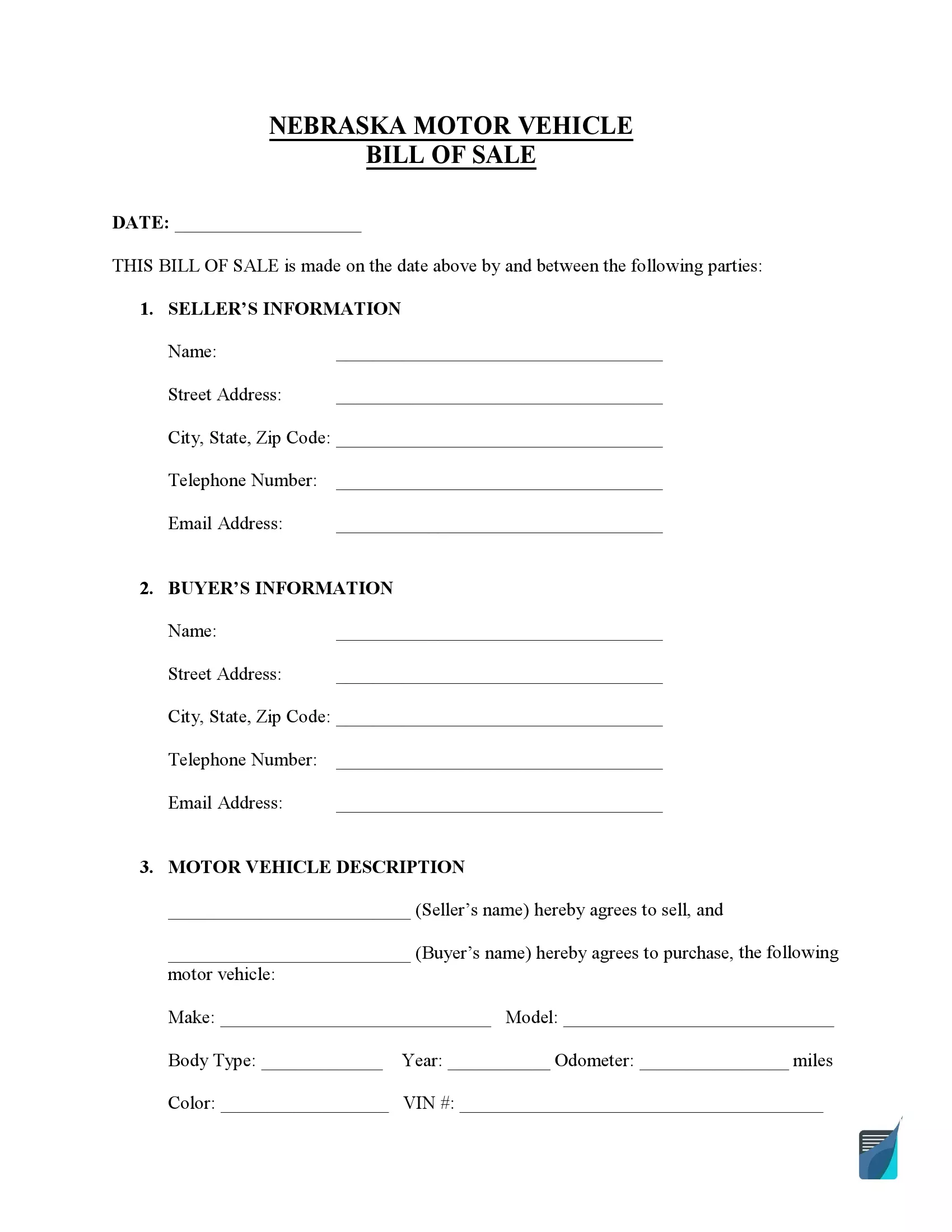

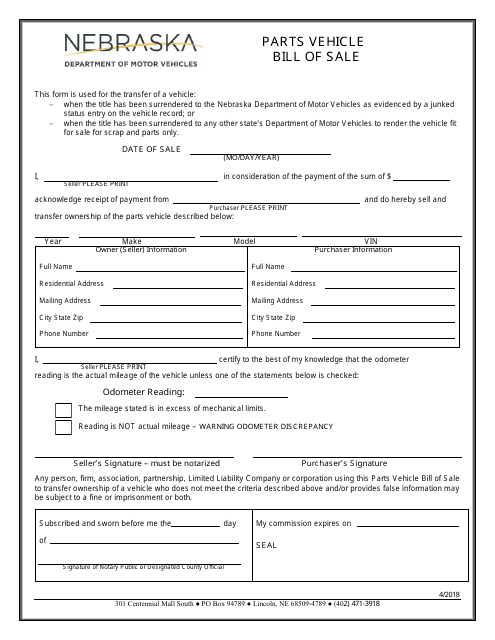

2014 2022 Form Ne Parts Vehicle Bill Of Sale Fill Online Printable Fillable Blank Pdffiller

Latest Information On Dmv Services Nebraska Department Of Motor Vehicles

2014 2022 Form Ne Parts Vehicle Bill Of Sale Fill Online Printable Fillable Blank Pdffiller

Bill Of Sale Nebraska Fill Online Printable Fillable Blank Pdffiller

Vehicle And Boat Registration Renewal Nebraska Dmv

Nebraska Sales Tax Small Business Guide Truic

Nebraska Parts Vehicle Bill Of Sale Download Fillable Pdf Templateroller